Gender-lens investing is gaining global momentum, but more slowly in India. Photo credit: fizkes / 123RF.

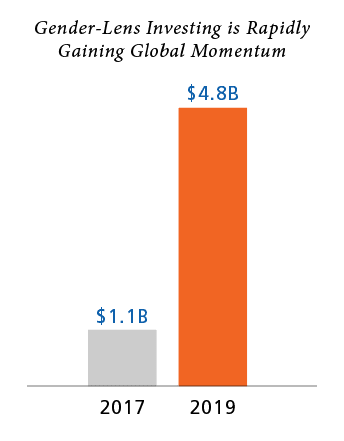

Gender-lens or gender-smart investing refers to investments that achieve greater social and financial return on investment by focusing on businesses that are owned or led by women, have good gender balance, and/or serve women customers with their products and services. Given this double benefit, gender-lens investing is rapidly gaining momentum globally, with volumes of capital raised across private equity, venture capital, and private debt vehicles growing from $1.1 billion in 2017 to $4.8 billion in 2019. This includes various funds that are specifically looking to invest in women-led start-ups.

However, few Indian investors are proactively considering gender as part of their investment thesis. FSG’s recent in-depth conversations with more than 20 leading impact investors in India revealed that while many expressed interest in the theme of gender-lens investing, few of them actively incorporated gender into their investment strategies and processes. Of the funds we spoke to, only three commercial funds had an explicit focus on serving women entrepreneurs, and no funds focused on women-owned businesses or had a gender-based investment focus.

However, few Indian investors are proactively considering gender as part of their investment thesis. FSG’s recent in-depth conversations with more than 20 leading impact investors in India revealed that while many expressed interest in the theme of gender-lens investing, few of them actively incorporated gender into their investment strategies and processes. Of the funds we spoke to, only three commercial funds had an explicit focus on serving women entrepreneurs, and no funds focused on women-owned businesses or had a gender-based investment focus.

For most impact investors in India, it became clear through our conversations that outcomes related to gender are incidental rather than actively pursued. As a result, they are missing an opportunity to increase their returns by deepening the social impact they create for women.

Impact investors in India can unlock significant social and financial value by investing in women

Around the world, there is growing evidence to suggest that diverse, women-led startups and businesses are financially more successful than their peers. The International Finance Corporation found that companies with gender-balanced leadership teams had valuation increases up to 25% higher than those with non-diverse teams. Early evidence also suggests that businesses founded by women ultimately deliver higher revenue—more than twice as much per dollar invested—than those founded by men.

Women-led ventures can open up new opportunities for competitive differentiation. The lived experience of women leaders helps them better identify ways to meet a range of needs specific to women that are not being addressed by existing products, services, or business models.

In India, women-owned businesses address needs ranging from increasing access to life-saving technologies to breaking taboos. Health tech start-up Niramai has developed a non-invasive breast screening methodology that is low-cost, portable, and pain-free, also allowing women privacy during screening. All of these factors are key to ensuring the adoption of breast screening practices for women in India’s smaller towns and rural areas.

Sheroes, a social network exclusively dedicated to women, provides 16 million women a safe space to connect with peers on common issues and challenges. It builds a sense of community by providing additional services, such as buying and selling products, counseling services, and short-term loans through tie-ups with non-banking financial institutions.

Also breaking boundaries, Zivame has improved Indian women’s experience of shopping for lingerie. The company has normalized intimate wear, a taboo topic in India, by redefining the sales process and helping women understand and embrace their unique body types, building confidence and self-worth.

Adopting a gender lens requires investors to adapt the ways in which they operate

Despite the promise of impact and returns, women-owned businesses in India lack access to capital. Only 12% of total Indian start-ups that raised funding in 2019 had at least one female co-founder, down from 17% the year before. This echoes findings from the work of academics interviewed by FSG, who discovered that women account for less than 1% of Indian founders who receive funding in Series A and beyond.

Indian investors are clearly not capitalizing on the opportunity to generate superior returns for their funds by improving the economic inclusion of women in India. While the limited number of women-owned businesses is a part of the challenge, perhaps a greater challenge is that many investors lack the skills and practices required to invest in women. Fortunately, there is a growing number of guidance and tools for fund managers and impact investors to effectively apply a gender-lens across their portfolio and in their firms.

Drawing upon these and our own research, we recommend five priority actions along the investment lifecycle that impact investors and philanthropic actors can take to boost investment in women-owned businesses and deliver great social impact across India.

- Expand networks and deal-sourcing channels to surface female founders. Our conversations indicated that women founders raise funds differently from men and might need a different approach to outreach and identification. Investors can partner with angel investors, incubators, and accelerators that directly support women-owned businesses—such as Her & Now, Goldman Sachs’s 10,000 Women initiative, and Startup Oasis—to intentionally diversify their investment pipeline.

- Adapt the criteria for evaluating potential investees to reduce bias. Investors we spoke to note that women tend to be more conservative (and realistic) in their business projections. Adjusting for this difference when evaluating projections of men and women founders can help investors compare like for like. Investors also need to actively avoid evaluating women based on personal circumstances, such as asking female founders of childbearing age how they would juggle childcare with running a business. Collecting sex-disaggregated data on founders at different levels of the investment pipeline can also be valuable in identifying drop-off points and finding ways to reduce them.

- Strengthen gender diversity within the investment team to accurately evaluate businesses that meet needs specific to women. Male investors may not be able to grasp the full potential of a new product, service, or business model because they do not have first-hand experience of the need it seeks to address. Anecdotal evidence suggests that, when faced with these types of propositions, male analysts often turn to women in their lives (wives, sisters) for feedback, making value judgments based on these opinions. Having women in investment teams helps reduce bias by making accurate assessments of potential women-owned investee businesses.

- Tailor investment instruments to the specific needs of women-owned businesses. This requires starting from the perspective of the business, rather than from the needs of the investor. Equipped with this knowledge, investors are better able to deploy their capital to nurture the business as it grows in sustainable ways. This might mean providing greater flexibility in deal types and terms, offering additional coaching and business support, or creating entirely new instruments that set the precedent for new ways of investing.

- Communicate (or partner) with investors at different stages to increase funding options for female founders. Building connections among early-stage or angel investors (including philanthropic entities), Series A+ investors, commercial lenders, and government programs can be valuable ways for investors to help women-owned businesses bridge the funding gap as their capital requirements grow.

We recognize the tremendous potential applying a gender-lens will unlock for Indian funders, investors, and female founders. This blog is an invitation to partner with us to explore how your organization can be among the first-movers in India and deliver greater financial and social returns for your investment. Please connect with us on LinkedIn and reach out to discuss:

Below, we share a set of resources that could be valuable for investors paving the way for accelerating gender-lens investing in India and beyond. We look forward to continuing to support the movement, and are enthusiastic about learning together with others in the space.

Useful Resources and Toolkits

- IFC and CDC (2020), Private Equity and Value Creation: A Fund Manager’s Guide to Gender-smart Investing

- IFC (2019), Moving Toward Gender Balance in Private Equity and Venture Capital in Emerging Markets

- Wharton and Catalyst at Large, (2020), Project Sage 3.0: Project Sage 3.0: Tracking Venture Capital, Private Equity, and Private Debt with a Gender Lens

- FSG (2020), Impact Investing Opportunities in India for Catalytic Investors

- FSG, Stanford Social Innovation Review (2020), What Investors Need to Know to Embrace Catalytic Capital

Learn more about FSG’s Gender Equity work >