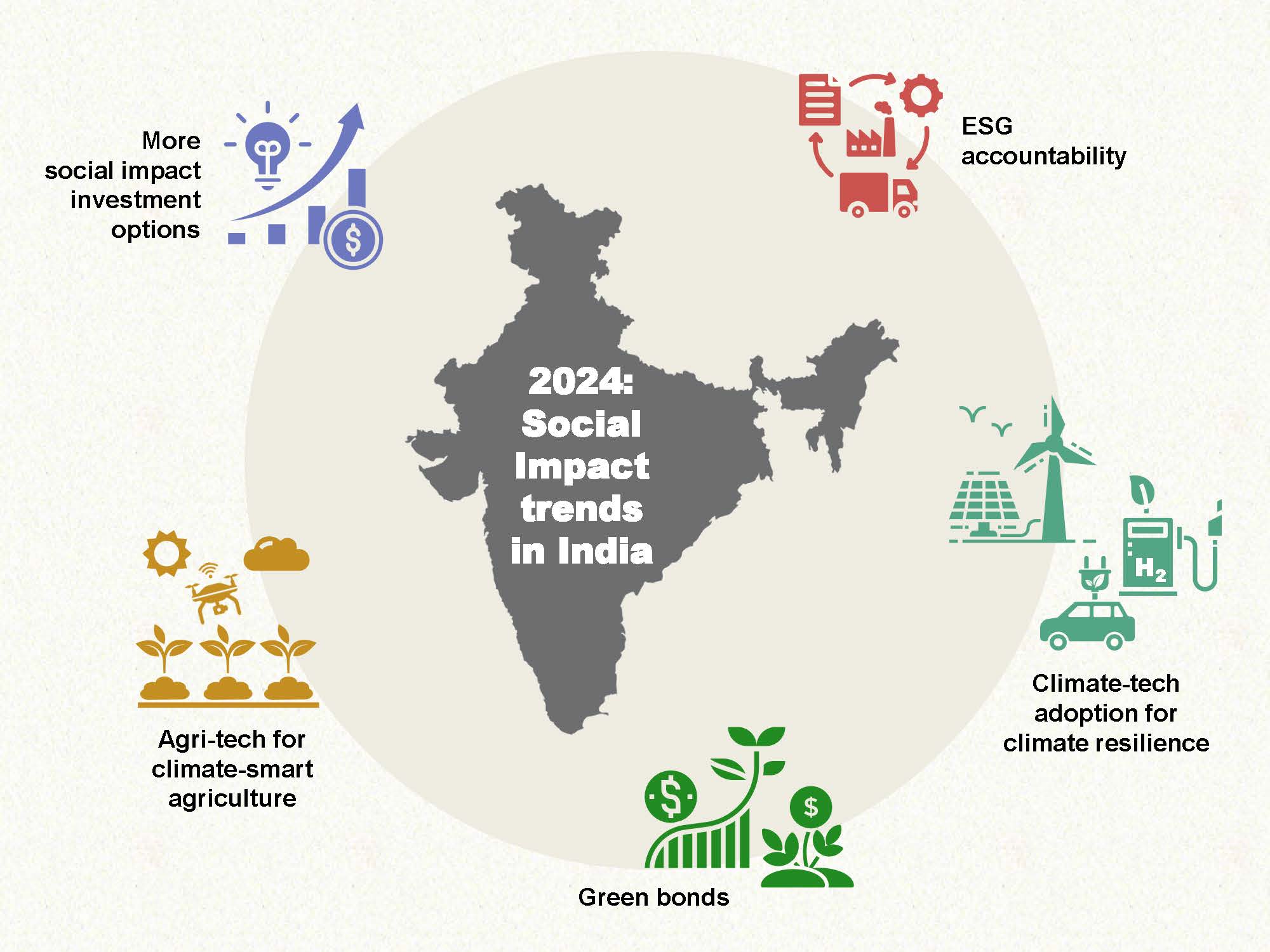

Stepping into the New Year, India will look to strike a fine balance—harmonizing development and inclusive prosperity with environmental stewardship. Against this backdrop, the intersection of innovation and social responsibility will increasingly take center stage. Already, regulatory shifts, technological strides, and a redefined investor mindset foretell an exciting trajectory for social impact in the country. Here’s a look at what we believe 2024 holds in store:

Greater ESG accountability and value chain transparency

When the next financial year kicks in, a larger section of India Inc. will have to account for the environmental and societal impact of its value chains. Aimed at addressing the need for ESG disclosure assurance, SEBI’s BRSR Core mandates that from April 1, 2024, India’s top 250 listed entities will have to provide value chain ESG disclosures on a `comply or explain’ basis. The top 150 listed entities are required to do so in the current financial year. And, while it is voluntary for the rest of the top 1000 companies (by market capitalization), it will be mandatory for these companies soon.

For companies, especially those engaging with MSMEs, the challenge will extend beyond regulatory compliance to effective stakeholder engagement. Achieving the stipulated 75% value chain disclosure as per the BRSR Core will require a proactive collaboration framework and investments in systems facilitating precise data collection. Companies will be forced to navigate stakeholder relationships proactively, ensuring timely and comprehensive data that aligns seamlessly with the evolving standards of responsible business conduct. Consequently, the demand for AI-powered ESG tools that help companies measure, track, and report on their sustainability and CSR efforts will keep growing.

Greater adoption of climate-tech solutions across sectors for climate mitigation and adaptation

The record-breaking intensity of the past year’s heat felt across the world has emphasized the urgent need to prioritize climate resilience efforts globally. A heightened focus on developing climate resilience will drive investments in, and adoption of, climate-tech solutions across sectors.

Solutions in the mobility and energy sectors will likely continue to dominate attention in the climate-tech landscape in the country. While battery-powered electric vehicles (EVs) have hogged the limelight in the mobility sector, range anxiety and fuel efficiency concerns persist. As a result, EV penetration in India’s four-wheeler segment has remained negligible. In the year ahead, green hydrogen-fueled mobility is expected to gain traction, given the government’s push on the National Green Hydrogen Mission. For India’s clean energy transition, enhancing integration of renewables in the power grid, and the development of hydrogen production, storage, and distribution infrastructure will be key focus areas going ahead. Green infrastructure will be key to fostering adaptive capacity and mitigating climate change. Increasing affluence and temperatures mean that clean cooling would be a major push for the long run, with early initiatives in 2024.

More green bonds

The success of India’s maiden sovereign green bond in early 2023 could serve as a beacon for climate finance and set the stage in the coming year for private-sector green bonds. In 2024, the government has plans to issue sovereign green bonds worth Rs. 10,000 crore, split evenly across two tranches but with different maturities. According to the RBI’s proposed issuance calendar, the first tranche worth Rs. 5,000 crore is set to hit the market between January 15 and 19, and the second between January 29 and February 2.

Issuing sovereign green bonds demonstrates national leadership in the green financing agenda. These sovereign bonds will help benchmark the yield curve and set best practices that encourage the private sector to follow suit and issue their own green bonds. While the maiden issue largely saw interest from domestic players, demand from global investors is expected to pick up going forward.

Leveraging agri-tech solutions for climate-resilient agriculture

Greater agri-tech adoption is the keystone that is bridging traditional farming practices with modern innovation and will be the key to increasing farmers’ resilience to climate change. These solutions have the potential to improve farmers’ incomes and livelihoods and ensure food security for the future. Going forward, we expect the funding slump in Indian agri-tech to continue into the last quarter of FY24, before investments bounce back in FY25. Investors are likely to continue being cautious, and channel their limited funding toward established business models, such as follow-on funding for companies in the mid-stream agri-tech category and companies with strong unit economics and a clear path to profitability. Agri-tech start-ups, on their part, will continue focusing on profitability to tide over the next financial year.

Traditional agriculture companies are expected to persist with a cautious approach, expanding into areas adjacent to their core business line rather than placing big bets in new value chain stages where they have limited expertise, resources, and farmer networks.

Sustainable solutions and climate-smart agriculture will be key thrust areas in the Indian agri-tech sector, driven by a growing focus on environmental conservation and climate resilience. 2024 will see continued innovation by agri-tech businesses in India offering solutions that can bridge the gap between small farmers and climate-resilient agriculture on multiple fronts – climate-resilient inputs, in-farm solutions, advanced weather monitoring systems for climate-smart agriculture, and insurance solutions. Meanwhile, the government is expected to sustain its efforts in digitizing, collectivizing, and mechanizing Indian agriculture.

A wider array of social impact investment opportunities

ESG factor-based investing and the total assets under management of ESG funds are expected to grow in the year ahead, with the market regulator SEBI looking to develop this segment and encourage more fund houses to offer ESG schemes. It has allowed asset management companies to launch up to six different types of funds under the ESG category of mutual funds. The move could support the growing need for green finance by directing more mutual fund investments towards ESG-complaint companies. Investors will have a larger product basket to choose from, and more precise tools to align their investments with their specific sustainability goals.

Additionally, the investment base for non-profit organizations (NPOs) engaged in social impact in the country is set to broaden, as several NPOs are expected to get listed on the Social Stock Exchange (SSE) in 2024 to raise funds for their work. The SSE enables investors to subscribe to zero-coupon, zero-principal (ZCZP) bonds of NPOs. The lead was set by SGBS Unnati Foundation in December 2023, when it became the first NPO to be listed on the SSE. Exchange officials have already indicated that three-four more NPOs may get listed by March 2024. According to the NSE website, there are 38 NGOs registered with the SSE. By allowing smaller issue sizes and reducing the minimum application size, the SSE gives retail investors an opportunity to contribute to social impact. The SSE’s association with bodies like SEBI, BSE, and NSE could also lend greater credibility to NGOs, potentially attracting a wider pool of investors.

As we look ahead, therefore, we see a journey marked by greater accountability, sustainability, and a heightened sense of social consciousness.

Rishi Agarwal is Managing Director and Head-Asia at FSG, a global mission driven consulting firm that partners with foundations and corporations to create equitable systems change.