Harvard Business Review | Fall 2022

Recognized as one of the top 3 best HBR articles of 2022!

ESG funds are projected to reach $53 trillion by 2025. But despite years of effort to integrate ESG and financial performance in business, strategic decisions continue to be made in ways that lead to social and environmental damage.

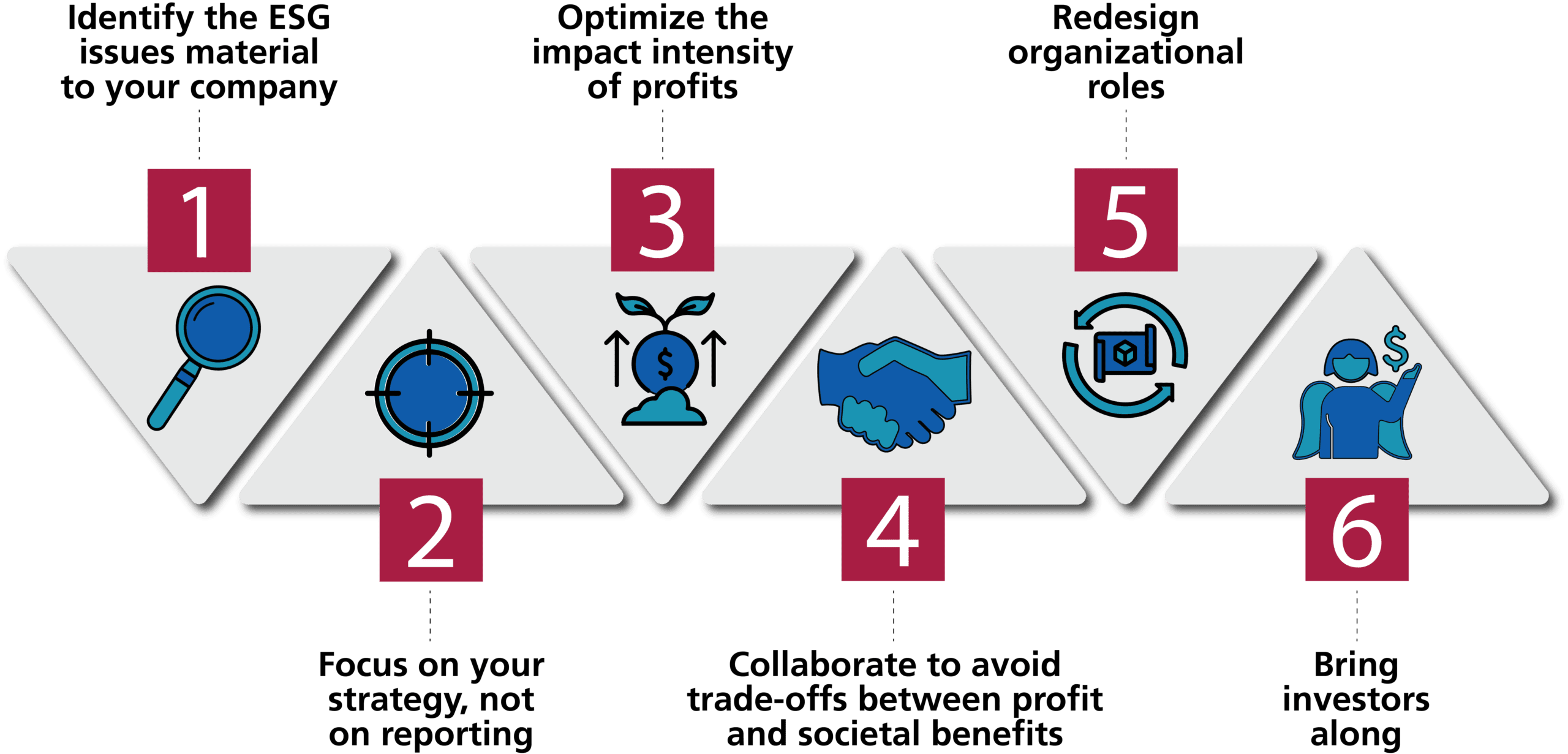

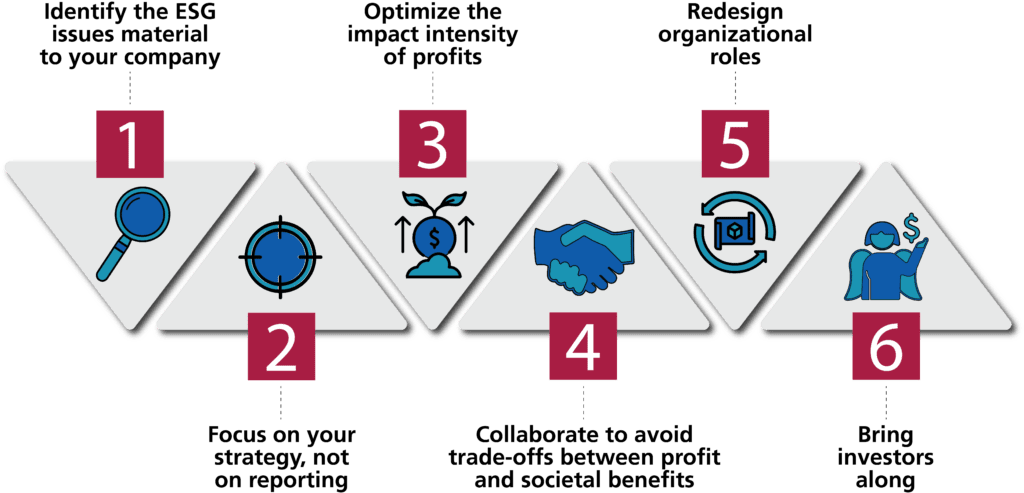

Mark Kramer and Marc Pfitzer describe why doing the math on the “impact intensity of profit” is necessary to meet both financial and ESG targets and thus open the way to exploring business model and ecosystem transformation that will outcompete in today’s economy.

They propose a six-step process that companies can use to fully integrate ESG performance into their core business models.

“Companies that don’t link the social and environmental consequences of their businesses directly to their business models and strategic choices will never fully deliver on their ESG commitments,” the authors warn in their article.