With increasing recognition that markets today create wealth and positive social impact inequitably and deplete or degrade natural resources, more companies must rethink their purpose and strategies in order to provide real and lasting solutions to these substantial problems. In the process, they must identify new business models to ensure a more positive impact on key environmental and social conditions and set themselves ambitious financial and social targets.

Those companies that are pursuing an authentic societal purpose (as opposed to those who simply seek a quick PR win) will quickly ask themselves how to allocate capital differently across their portfolio of businesses and activities in order to meet both sets of targets. This is not an easy exercise as, today, no accounting or measurement system exists to link financial and societal performance at a corporate level and enable purpose-driven capital allocation.

The role of economics of impact

Consider a hypothetical global meat and protein company[1] with $30bn in sales from beef (53%), chicken (45%) and alternative proteins (2%) that has adopted the corporate purpose of producing sustainable proteins to feed the world for generations to come. In line with its purpose, the company has set itself both ambitious commercial and societal targets for 2025 and 2030 (including halving land use and reducing CO2 emissions by 30%).

A quick look behind the scenes, however, shows that financial and societal targets are not reconciled and that meeting both of them requires the company to fundamentally rethink how it does business. With 60% of operating income, the beef segment is a key pillar of the firm’s profitability. At the same time, it is driving 98% of the company’s CO2 emissions and 86% of land and water usage.

Should the company transform its businesses away from beef and chicken and shift to alternative proteins? Observations of key trends around healthier and more sustainable nutrition and the comparatively significantly lower greenhouse gas, land, and water use footprint would suggest this. Furthermore, there has been attractive market growth of vegetable protein over the past years and there are opportunities to benefit from the recent hype of alternative protein companies such as Beyond Meat (estimated P/E ratio for 2021: 357).

In reality, however, it is very unlikely that the company would go down this route of transformation, even at a moderate pace. The late Harvard Business School Professor Clayton Christensen explained that companies are more inclined to invest in increasing efficiencies instead of disruptive innovations. Any disruption and business transformation comes with short and medium-term trade-offs on profits and return on capital. So even if a company adopts an authentic purpose, it is extremely difficult for executives to translate it into a coherent strategy that reconciles societal and financial performance and enables the company to engage its internal and external stakeholders effectively, including investors.

Understanding the economics of impact can change this, as it requires identifying the most important revenue-side impacts (markets, products, and services) and cost-side impacts (value chains). This allows companies to holistically assess how shifting the portfolio of businesses and operations reinforces or changes impact and profitability levels. Such relationships can be measured through hybrid performance metrics that connect key social impact areas with financial measures.

Over recent years, we have seen a significant increase in companies tracking their societal impact through tools such as ESG and the Global Reporting Initiative’s standards. These tools play an important role in helping companies understand their impact, but they fall short of helping project the economics and strategic relevance of changing them. What is needed are hybrid metrics, targets, and corporate performance management that enable capturing how profitably a company is operating in line with its purpose.

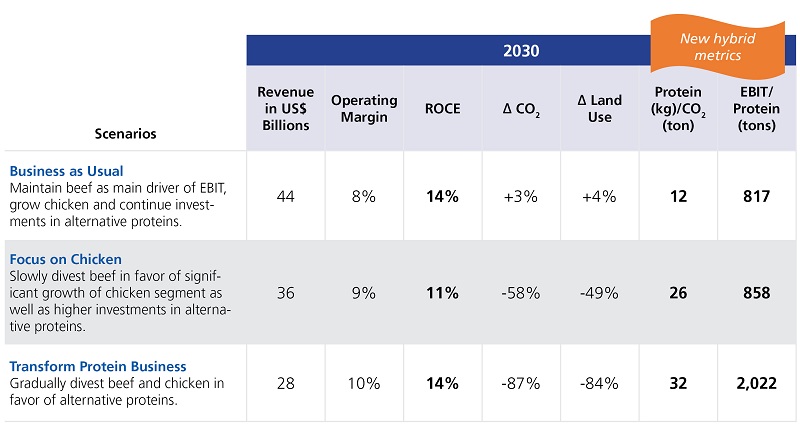

For our hypothetical meat and protein company, we could imagine the executive team choosing to look at the environmental footprint intensity (for example CO2 emissions or land use per kg of protein) and the profitability of the protein produced as a way to measure both profit and social impact. High-level modeling of different pathways for transformation show very different outcomes by 2030 as measured by two hybrid metrics:

This example is extremely simplified and many companies face more complex choices as different societal impacts can be more or less material for specific businesses in the portfolio. Furthermore, supply chain activities can be shared across products and businesses and can affect societal issues in different, sometimes even in opposing ways. Nonetheless, any company that is committed to living up to its purpose will have to understand its economics of impact to inform its strategy and capital allocation. The ability of identifying the right hybrid performance metrics for a company’s purpose is actually a great stress-test for its quality—a purpose worth having.

The four strategic choices for transforming business portfolios

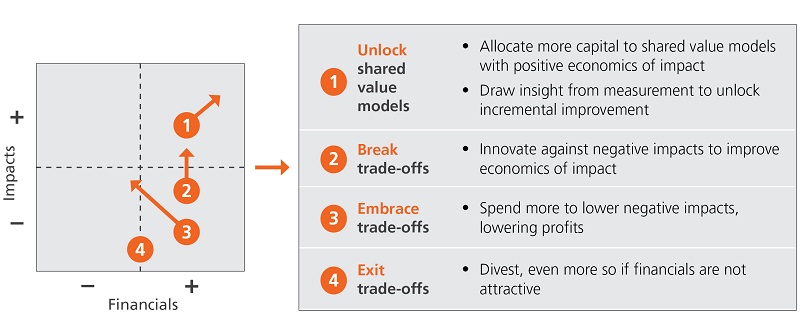

Every company creates both positive and negative impacts. Understanding how changing these impacts positively—increasing positive impact further and eliminating negative impacts over time—allows executives to inform the strategic choices required to pursue their purpose authentically.

An authentic purpose points to the most material social impact for the business and allows developing hybrid performance metrics to measure how profitably the company is doing good or transforming towards doing better. Companies can map their portfolio of businesses and activities with regard to their respective positive or negative contribution to the corporate purpose. Insights on the economics of impact allow executives to see how transforming the portfolio will change the company’s financial and social performance. There are typically four types of businesses or activities within a corporate portfolio:

- Those that contribute both to creating positive impact and making progress against social and environmental targets while also making a profit. This is the case for shared value business models, for example, healthy alternative protein products, where business growth is inherently tied to positive societal impact.

- Those that are currently impact-negative or neutral while being profitable but where there is a potential for creating shared value business models through innovation. An example could be a car manufacturer innovating around e-mobility and shared ownership to reduce its product footprint over time.

- Those that are impact-negative while being profitable and where there is little to no potential for innovation against negative impacts. For example, buying carbon off-sets for businesses with high levels of essential travel, potentially significantly reducing profits.

- Those that are impact-negative and not contributing significantly to profits or even running a loss, for example divesting from low margin plastic bottle business to reduce overall plastics footprint.

Gaining clarity about the strategic choices will enable companies to develop more purpose-led strategies and more effectively engage stakeholders in different pathways for transforming the portfolio of businesses and activities and put certain short to mid-term trade-offs into perspective.

Five steps to purpose-led performance management and decision making

Companies that have identified their purpose can follow five steps to leverage economics of impact as a management tool:

- Identify the positive and negative societal impacts of the company that are most materially linked to financials and are also most relevant for fulfilling the company’s purpose.

- Understand the robustness of data and measurement to date on targeted societal indicators and current levels of impact.

- Understand how societal indicators link with specific units of revenue and costs so you can establish economics of impact.

- Outline how strategic choices affect key revenue, cost units, and capital allocation and therefore hybrid performance.

- Build a hybrid performance metrics management system and develop an investor communications plan.

We see more and more companies adopting a purpose to show that they are contributing to fixing the world’s most pressing problems and in response to increasing pressure, such as BlackRock CEO Larry Fink’s 2018 letter to CEOs. However, unless companies translate their purpose into a new form of corporate performance management that uses economics of impact to reconcile financial and societal performance, they will fail to convince stakeholders that it is anything but business as usual. Without the full picture to inform strategic choices and capital allocation in a way that favors hybrid performance and shared value business model innovation, companies will not be authentic and stakeholders will call this out sooner or later.

Learn more about FSG’s Corporate/CSR work >

[1] The meat and protein company is a semi-i

llustrative example based on real business data (2013-2019) of leading global meat and alternative meat companies. Projections are based on relative proportions from 2013-2019 data for revenues, operating margins, assets and liabilities. Product footprint data (scope 3) is based on Nijdam et al. (2012); The price of protein: Review of land use and carbon footprints from life cycle assessments of animal food products and their substitutes; Food Policy and data from the Institute of Water Education at UNESCO Growth projections for alternative proteins are based on assumptions and real business data (2013-2019) of prepared foods benchmarks and McKinsey: Alternative proteins: The race for market share is on; August 2019.